Blog

How to Invest in Commercial Real Estate

Research

Dodd-Frank’s approval in 2011 was one of the most comprehensive overhauls of financial regulation in U.S. history. To curb predatory lending, among other provisions, Dodd-Frank required financial institutions to engage in more detailed and costlier verification of applicants’ income, collateral value, and employment information, and to engage in the training of mortgage loan officers.

Financial institutions argued that these requirements would have increased the costs of originating mortgages —so much so that small- and medium-sized mortgages might have become cost ineffective. Verifying income and collateral values costs the same for a low-income and a high-income applicant, but originators earn higher profits on larger mortgages. Originators might have switched to originating more jumbo mortgages and cutting on smaller mortgages, thus producing a regressive redistribution of residential mortgage credit from the poor to the wealthy.

The Research

Was this doomsday prophecy exaggerated or did it come true? D’Acunto and Alberto Rossi, Hachigan Family Professor of Finance, provide empirical evidence that it came true. The authors collected information for every single residential mortgage originated in the United States in each year from 2008 onwards.

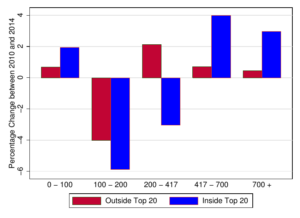

Armed with these comprehensive data, the authors first computed the change in the value of all mortgage originations of various sizes in the years after Dodd-Frank relative to the years before. Figure 1 plots this change separately for the top 20 U.S. mortgage originators (blue) and other mortgage originators (red). We can see that the origination of mortgages smaller than $200K declined drastically after Dodd-Frank. By contrast, the origination of jumbo mortgages (above the back-then conforming loan limit of $417K) increased dramatically.

Figure 1. Regressive Redistribution of Mortgage Credit After Dodd-Frank

Bars show the change in the amount of mortgage credit extended to mortgages of various sizes, from smaller than $100K (leftmost bars) to larger than $700K (rightmost bars) and separately for the 20 largest U.S. mortgage originators (blue) and other mortgage originators (red).

Figure 1 also shows that larger mortgage originators reacted more than other financial institutions, which further aggravates the redistribution of mortgage credit from the poor to the rich given that larger originators account for a bigger share of all the mortgages originated in the United States.

For the same reason, communities in locations in which larger mortgage originators have a higher market share should have suffered a larger redistribution of mortgage credit, which the authors find, too (see Figure 2). FinTech originators such as Quicken Loans, whose mortgages are also part of the data, did not change this pattern.

Figure 2. Regressive Redistribution of Mortgage Credit After Dodd-Frank, by U.S. Counties

Darker U.S. counties faced higher redistribution from small/mid-sized mortgages to large mortgages.

What do we conclude from this research?

Blog

Blog

Blog