Research

Clark Quick Take: Why All Real Estate Faces the Costs of Climate Change

Research

Investing in energy-efficient technologies and infrastructure is increasingly portrayed as a major driver of market value for commercial real estate properties. Despite a long-standing debate, assessing the value that U.S. commercial real estate operators attach to energy efficiency is still elusive. On top of the baseline value of energy efficiency, an overlooked aspect is that when the demand for green energy sources spikes the demand for brown sources drops, which makes brown sources relatively cheaper and more attractive economically over time. How can we quantify these second-order effects on the relative value of green vs. brown energy sources?

The Research

A recent academic paper from Steers Center’s 2023 research fellow, Mr. Andrea Savio, proposes the first steps to tackle this question. The paper benchmarks the paths of adoption of energy efficiency in commercial real estate to those in the manufacturing sector —a natural benchmark given that both sectors faced a push to convert to green energy sources over the last two decades. To assess the potential second-order effects of changes in the demand for green sources on the economic viability of brown sources, the paper employs newly available data collected from a set of U.S. sources on the split of usage of renewable sources and carbon fossil energy sources by sector and over time.

Savio develops a statistical model called UCTT multivariate diffusion model to examine and compare the diffusion of coal, gas, and biomass as sources of the energy used in the U.S. commercial real estate and manufacturing sectors over time. This model assesses the dynamics of adoption of each energy source and the direct and indirect effects across energy sources and sectors.

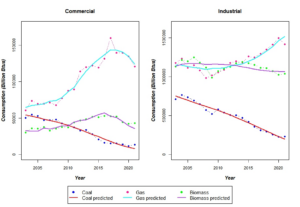

Figure 1 reports the raw data and modeled paths of energy-source adoption across sectors over the last two decades.

In the U.S. commercial real estate sector, the path to green energy transition is strong —biomass adoption, in particular, grows at sustained rates. At the same time, the higher efficiency and lower demand for competing brown sources (gas and coal) makes them relatively more cost-effective over time, which acts as a counteracting force to the path of transition to green sources.

For manufacturing, the higher viability of natural gas has crowded out the adoption of green sources over the last decade, leading to a flat or even declining path of adoption for green sources that has no parallel in commercial real estate.

Ultimately, the existing data and predictive model suggest a sustained adoption of green sources in U.S. commercial real estate largely because of the lack of a crowding out effect, which instead is strong in manufacturing.

Figure 1. Observed and model-predicted time series of energy consumption for electricity generation and useful thermal output of coal, gas, and biomass in the U.S commercial real estate and manufacturing sectors (2003-2021)

What do we conclude from this research?

Research

Blog

Research